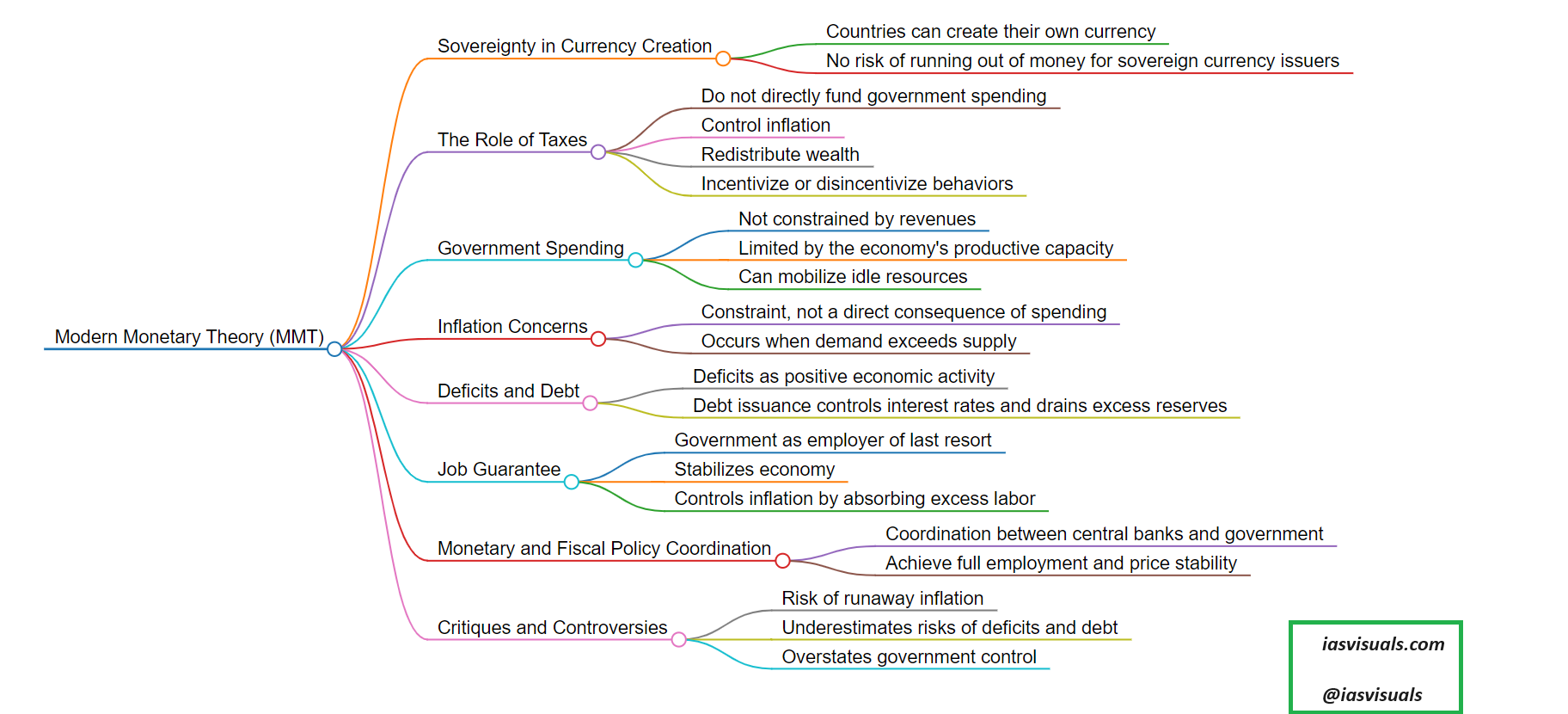

Modern Monetary Theory (MMT) is an economic framework that offers a different perspective on fiscal policy, government spending, and the role of money in a sovereign currency system. Here’s an outline of its key concepts:

Sovereignty in Currency Creation:

MMT states that countries that issue their own currencies (sovereign currency issuers) can never “run out” of money in the same way businesses or households can, because they can always create more of their own currency.

The Role of Taxes:

According to MMT, taxes do not fund government spending in a direct sense for a sovereign currency issuer. Instead, taxes serve several purposes, including controlling inflation, redistributing wealth, and incentivizing or disincentivizing certain behaviors.

Government Spending:

MMT posits that government spending is not constrained by revenues (like taxes and borrowing) but by the productive capacity of the economy. It argues that government can spend more without needing to find a direct source of revenue, as long as there are idle resources (like unemployed labor) that can be mobilized.

Inflation Concerns:

Inflation is viewed as a constraint, not a consequence, of government spending. MMT suggests that inflation occurs when the demand for goods and services exceeds the productive capacity of the economy, not simply when the government increases spending.

Deficits and Debt:

MMT reinterprets the nature of public deficits and debt. Deficits are seen as money that the government spends into the economy and doesn’t tax back, which can lead to positive economic activity. Debt issuance is a way to control interest rates and drain excess reserves, rather than a necessity to fund expenditures.

Job Guarantee:

A central policy proposal of MMT is the job guarantee, which proposes that the government should offer a job to anyone willing and able to work, thereby achieving full employment. This policy is aimed at stabilizing the economy and controlling inflation by absorbing excess labor during downturns.

Monetary and Fiscal Policy Coordination:

MMT emphasizes the coordination between monetary and fiscal policy, arguing that central banks should work in tandem with the government’s fiscal policy to achieve policy goals, such as full employment and price stability.

Critiques and Controversies:

Critics of MMT argue that its policies could lead to runaway inflation, that it underestimates the risks of large deficits and debt, and that it overstates the capacity of governments to control economic outcomes. Supporters argue that traditional economic models fail to accurately describe how modern economies and sovereign currencies function.

MMT presents a paradigm shift in understanding fiscal policy, money, and the economy, challenging conventional wisdom about the role of government spending and monetary policy. It has gained attention and sparked debate among economists, policymakers, and the public, especially in the context of discussions about how to address economic inequality, unemployment, and climate change.