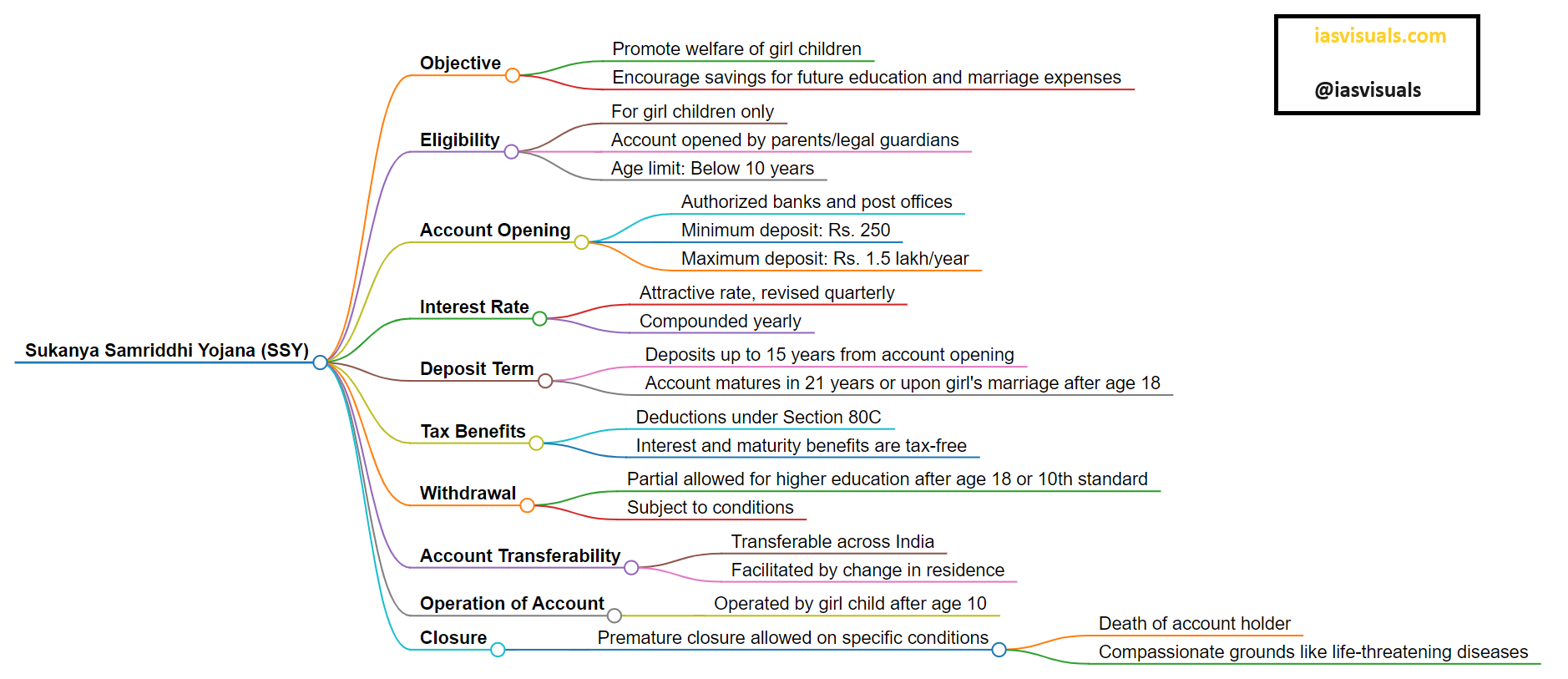

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme in India aimed at encouraging parents to save for their girl child’s future education and marriage expenses. Here are the key points about the scheme:

Objective :

To promote the welfare of girl children in India by encouraging savings for their future.

Eligibility :

The scheme is available for girl children only. The account can be opened by the parents or legal guardians of a girl child below the age of 10 years.

Account Opening :

Can be opened in authorized banks and post offices across India with a minimum deposit of Rs. 250 and a maximum of Rs. 1.5 lakh in a financial year.

Interest Rate :

The scheme offers an attractive interest rate, which is revised quarterly by the government. The interest is compounded yearly.

Deposit Term :

Deposits in the account can be made for up to 15 years from the date of opening the account. The account matures in 21 years from the date of opening or upon the girl child’s marriage after reaching the age of 18.

Tax Benefits :

Investments made under SSY qualify for tax deductions under Section 80C of the Income Tax Act, and the interest earned and maturity benefits are tax-free.

Withdrawal :

Partial withdrawal is permitted for the girl’s higher education purposes after she turns 18 years old or has completed the 10th standard, subject to certain conditions.

Account Transferability :

The account can be transferred anywhere in India if the girl child moves to a place other than the city or locality where the account was opened.

Operation of Account :

The account can be operated by the girl child after she reaches the age of 10 years.

Closure :

Premature closure is allowed under specific circumstances, such as in the case of the account holder’s death or extreme compassionate grounds like medical support in life-threatening diseases.

This scheme is part of the “Beti Bachao, Beti Padhao” campaign and is designed to ensure a bright future for girl children in India by securing their educational and marriage expenses.