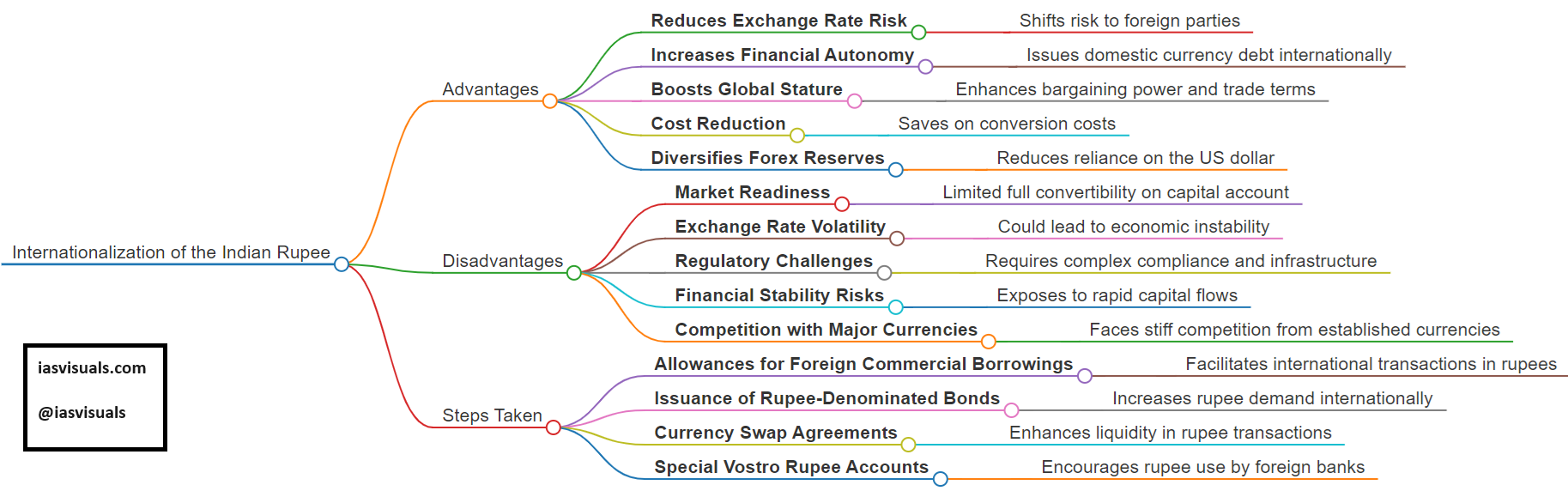

The internationalization of the Indian Rupee refers to the process of increasing the use of the rupee beyond India’s borders in international trade, investments, and reserves. This move aims to enhance India’s economic sovereignty and reduce dependency on major currencies like the USD. Here are the detailed advantages and disadvantages of this initiative:

Advantages:

- Reduces Exchange Rate Risk: Indian businesses can invoice and settle transactions in rupees, shifting the exchange rate risk to their foreign counterparts.

- Increases Financial Autonomy: It allows the government and private sector to issue debt in rupees on international markets, potentially reducing the need for foreign currency reserves.

- Boosts Global Stature: Enhances India’s influence in global financial markets by elevating the rupee’s role, improving trade terms, and increasing bargaining power.

- Cost Reduction: Saves on transaction costs associated with currency conversion, benefiting both businesses and the economy at large

- Diversifies Forex Reserves: Helps diversify India’s foreign exchange reserves away from the US dollar, potentially stabilizing the financial system

Disadvantages:

- Market Readiness: The rupee is not yet fully convertible on the capital account, limiting its attractiveness for international transactions.

- Exchange Rate Volatility: Internationalization could lead to higher volatility in the rupee’s value, affecting both domestic and international economic stability.

- Regulatory Challenges: Integrating with global financial markets requires complex regulatory compliance and could strain India’s financial infrastructure.

- Financial Stability Risks: Increased use of the rupee globally could expose India to new financial risks, such as rapid capital inflows and outflows that affect monetary policy.

- Competition with Major Currencies: The rupee faces stiff competition from established currencies like the US dollar, euro, and yen, which could hinder its acceptance.

To effectively manage and promote the internationalization of the rupee, India is undertaking several measures. These include allowing foreign commercial borrowings in rupees, issuing rupee-denominated bonds internationally, and engaging in currency swap agreements with other nations. The RBI is also promoting the opening of Special Vostro Rupee Accounts by foreign banks to facilitate trade in rupees.

This strategic move, while promising, requires careful management to maximize benefits and minimize risks associated with global financial dynamics and currency competition.