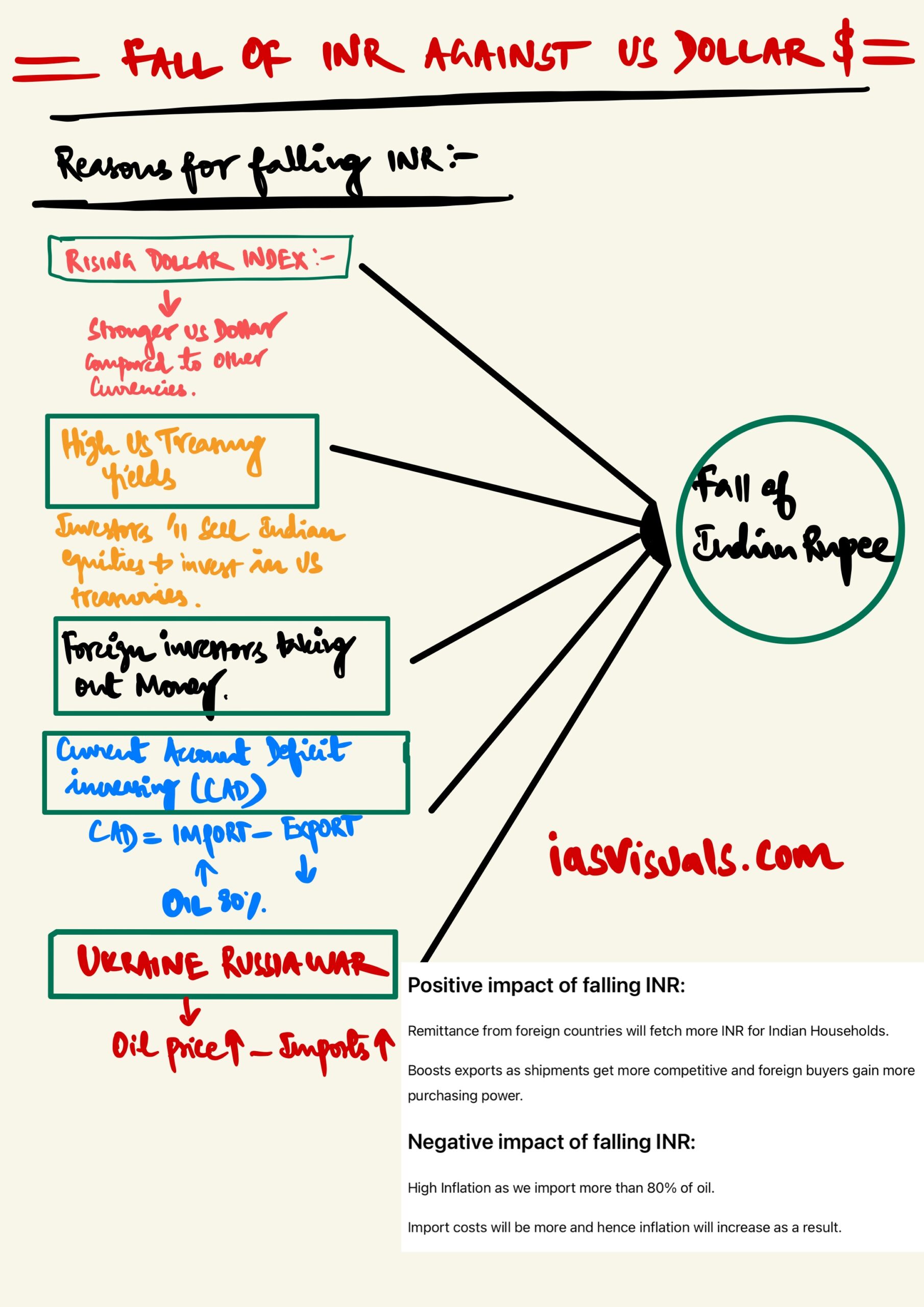

Reasons for falling INR:

The Rising Dollar Index:

Higher the Dollar Index moves, stronger the USD in comparison with the other world currencies. It means US dollar is in demand. The reason is uncertainty and high inflation in many developing nations. US Dollar is considered as a safe heaven.

US Treasury Yields provides a High Rate of Interest:

High yield is a clear incentive for foreign investors across the world to sell their investments in equity markets in India and move to safer options that are risk free. Which leads to selling of INR in Indian markets.

Foreign Investors taking out money:

More amount has been taken out from Indian markets than in 2008 crisis. Almost $28 billion has been taken out from Indian markets by Foreign Institutional Investors.

Current Account Deficit Increasing: CAD

Imports – Exports = CAD

High Imports mean more US dollars move out than what comes in. Hence Forex reserve is reducing gradually for the past 3 months.

Ukraine and Russia War:

This war has an impact as well with rising oil prices as we import more than 80% of our oil.

Positive impact of falling INR:

Remittance from foreign countries will fetch more INR for Indian Households.

Boosts exports as shipments get more competitive and foreign buyers gain more purchasing power.

Negative impact of falling INR:

High Inflation as we import more than 80% of oil.

Import costs will be more and hence inflation will increase as a result.